As a home care / elder care company, we at Support For Home talk to a lot of families about funding the costs of such care. One of the choices that a number of them face is whether to spend Long-Term Care Insurance (LTCI) dollars first or to save those monies and spend their own dollars first.

I am not an accountant, although my folks were, and maybe some of it rubbed off, in spite of my efforts to avoid it. 🙂 For me, the answer is really very simple, but that may just be because we deal with the question so frequently. To most families, there are so many things going on when home care is needed for a loved one that this important analysis almost gets lost in the background noise.

So, we will construct a scenario that is pretty realistic and will, I think, make clear why we feel using your Long-Term Care Insurance benefits before you spend any of your investment dollars is the right approach. This is going to involve a bit of arithmetic, but I think it is worth it.

First, however, I should say that for the other owner of Support For Home, my wife, no arithmetic is needed. For her, it is as simple as the fact that LTCI does not work like life insurance. If she gets run over by a beer truck — doubly unlucky, since she is not a great beer fan — her LTCI policy is worthless. Value? $0. Her words: “Spend the darn LTCI money while you are here to use it!”

That having been said, let us agree that the goal is to make our total dollars (investments and LTCI benefits) last as long as possible. The two possible scenarios we will explore are,

- Spend personal investment $ first, then spend LTCI benefit; or

- Spend LTCI benefits first, then spend personal investment money.

For the scenario, we will assume a total LTCI benefit of $150,000 and personal investment funds of the same amount. We can give the Long-Term Care Insurance policy the benefit of the doubt and say it has a 3% inflation rider baked in, which is not always the case. Let us also assume that we have home care costs of $2650 per month ($31,800 per year). Our investments should earn 6% per year, unless we have a lot of Studebaker stock (if you are too young to remember them, sorry).

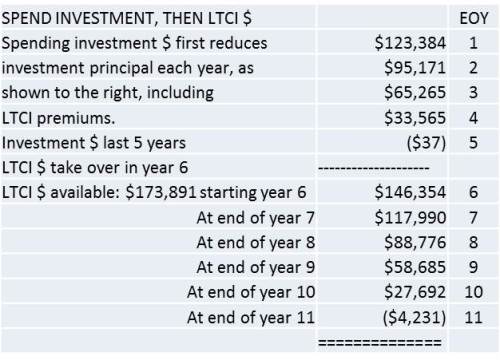

So, our first table looks like this:

Thus, your investment, allowed to grow, rather than being spent on home care, increases significantly more rapidly than your inflation-protected LTCI benefits. Growing that investment pot is a major part of the successful equation.

Now we can look at the two possible scenarios for using your total funds – LTCI and investment dollars.

As you can see, by the end of year 11, in the scenario where investment money is spent first, both LTCI benefits and investment dollars are gone.

So, what happens if you use your LTCI benefits first?

The bottom line is that your funds last an extra 1.7 years, by using the LTCI benefits first, saving your investment dollars. $9,000 of that saving, in our scenario, comes from not having to pay the $1,800 per year LTCI premium for the first five years of your care.

So, whether your goal is to maximize the length of your home care or preserve dollars for a later move to assisted living or skilled nursing, you are still better off using the LTCI insurance benefits at the beginning. If you do not have an inflation rider on your LTCI policy, the motivation to use your LTCI benefits first is even greater.

Oh, and remember, stay away from beer trucks.

Best wishes. Bert

Pingback: Long Term Care Insurance Covers To Cover You!